Home > Edu-Tech > Y Combinator: Decoding the World's Most Influential Startup Accelerator

Y Combinator: Decoding the World's Most Influential Startup Accelerator

Y Combinator is more than just a funding source; it is the ultimate launchpad for ambitious founders, transforming raw ideas into industry-defining companies

By :Thomas Inyang🕒 15 Jul 2025

Introduction

Y Combinator is the financial powerhouse behind companies like Airbnb, Stripe, and Reddit that became global giants. Y Combinator is more than just a funding source; it is the ultimate launchpad for ambitious founders, transforming raw ideas into industry-defining companies.

About YC: More Than Just Money

Founded in 2005, Y Combinator (YC) set out to redefine early-stage company building, and its mission is to "help founders launch, build, and scale the great technology companies of the next 100 years."

Their guiding principle, "Make something people want," emphasizes relentless focus on user needs and market fit. This philosophy has made YC the "best-known" and "most prestigious" startup accelerator globally, often called the "Harvard of startup accelerators."

Unmatched Scale: A Network That Powers Billions

YC's impact is staggering. It has funded over 5,000 companies since 2005, creating a community of over 7,000 founders. These alumni companies boast a combined valuation exceeding $800 billion, with over 100 achieving "unicorn" status (valued over $1 billion). Think Airbnb, Stripe, Coinbase, and Reddit—all YC alumni. Each accepted company receives a standard seed funding of $500,000.

This isn't just about numbers; it's about a powerful network. YC's private social network, "Bookface," connects founders to a vast pool of collective wisdom, mentorship, and business opportunities, creating a self-reinforcing cycle of success.

Inside the Accelerator: The Path to YC

YC's application is open globally, but it's highly competitive. Acceptance rates typically hover around 1-2%, with some sources indicating less than 1% , making it "harder to get into than Harvard". YC prioritizes the founding team over the initial idea, seeking strong, balanced teams with technical skills and a "hacker spirit".

Early traction and customer validation are also important. Applicants should focus on clarity, conciseness, authenticity, showcasing team strengths, and demonstrating growth and determination.

The 3-Month Sprint: Build, Don't Just Learn.

Once accepted, founders participate in an intensive three-month, in-person program in San Francisco. While structured, the formal time commitment is minimal, typically a few hours per week, allowing founders to focus intensely on building their product and engaging with customers.

This "controlled intensity" fosters a high-motivation environment, pushing founders to achieve remarkable progress. YC provides "intensive guidance, support, and structure." Each team gets a dedicated YC partner (a successful founder) who offers data-driven advice.

Founders also gain access to YC's extensive investor network, exclusive deals worth over $500,000, and a wealth of written advice. The program culminates in Demo Day, where startups present to investors, gaining significant visibility and a "huge fundraising advantage."

The SAFE Bet: Revolutionizing Startup Funding

Before YC, early-stage funding was complex. Then came the SAFE.

Simple Agreement for Future Equity (SAFE)

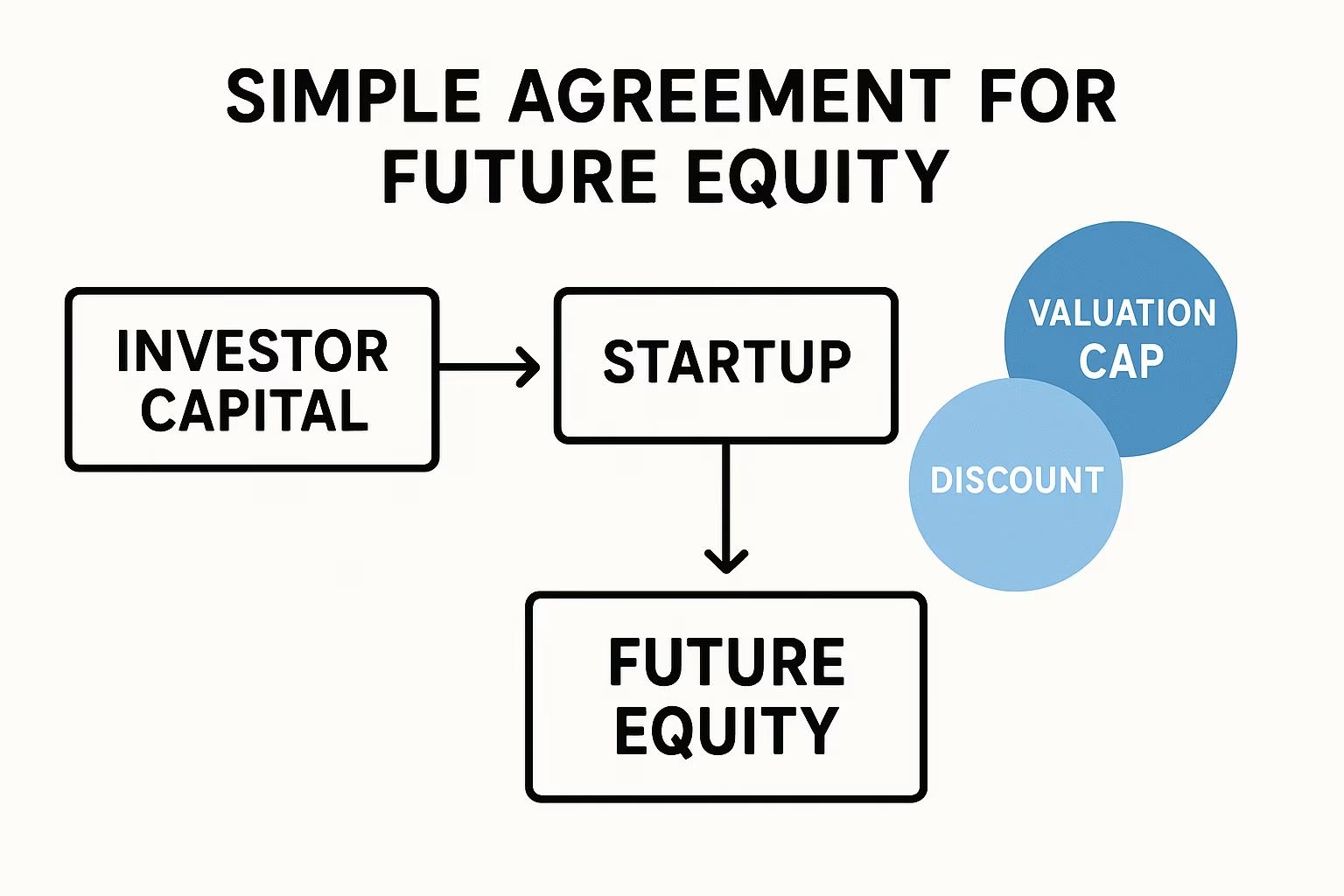

Introduced by YC in late 2013, the Simple Agreement for Future Equity (SAFE) has become the global standard for early-stage fundraising. It's an investment contract where investors provide capital now for future equity, typically converting during a later funding round or company sale.

The SAFE simplifies funding by avoiding immediate valuation and the complexities of traditional debt or equity. It's "more founder-friendly" because it lacks debt features like interest accrual or maturity dates, letting founders focus on building.

Key terms like "valuation caps" (setting a maximum valuation for conversion) and "discount rates" (allowing investors to buy shares cheaper than new investors) reward early investors for their risk. An optional Most Favored Nation (MFN) Clause ensures early investors get terms as good as or better than future investors, protecting them from dilution.

See Also: Google VEO 3 AI for Video Content Creation.

Compared to other instruments:

- SAFEs are equity warrants, not debt, with no interest or maturity date, deferring valuation until conversion.

- Convertible notes are debt that converts to equity, typically with interest and a maturity date.

- Equity financing involves immediate direct ownership, with valuation determined at investment, and is generally the most complex.

- Loans are pure debt, with interest and maturity dates, and do not convert to equity.10

SAFEs offer simplicity and cost-effectiveness for founders and high return potential for investors. However, founders face potential dilution, and investors risk no equity if triggering events don't occur (e.g., if the company becomes self-sufficient and never raises another round or is acquired).

YC's Expanding Influence

YC's reach extends far beyond its main accelerator.

Startup School & AI Startup School

It is a free online course offering YC's accumulated knowledge on starting a company, including a co-founder matching platform that has facilitated over 100,000 matches. It acts as a pipeline for future YC applicants.

In a strategic move, YC launched its first-ever AI Startup School in San Francisco in June. This highly selective, free event gathered 2,500 top AI students and researchers, and the event featured speakers like Elon Musk, Satya Nadella, Sam Altman, Andrew Ng, and Fei-Fei Li. This initiative aims to identify and nurture top AI talent and ideas early, ensuring YC stays at the forefront of technological shifts.

Other initiatives include YC Continuity (later-stage investments) and YC Research (fundamental research), demonstrating YC's comprehensive support across the startup lifecycle.

Navigating the Landscape: Legitimacy, Scams, and Challenges

While YC is highly legitimate, its prominence makes it a target for exploitation.

"Is Y Combinator Legit?" Absolutely.

YC's legitimacy is undeniable, backed by:

- Extraordinary Track Record: Incubating tech giants like Airbnb and Stripe.

- Rigorous Selection: A highly competitive application process with a 1-3% acceptance rate.

- Quality Mentorship: Guidance from experienced founders and a vast, data-informed network.

- Thought Leadership: Shaping industry standards and fostering knowledge sharing through platforms like Hacker News.

See Also: Claude 4 Models, Tools, and Development Workflows (2025)

This success creates a powerful "halo effect," attracting top talent and investors, reinforcing YC's market position.

"Y Combinator Scam" Queries: Brand Exploitation

Queries about "Y Combinator scam" and "Y Combinator text message" refer to fraudulent activities exploiting YC's brand. Scammers send unsolicited messages offering high-paying, flexible remote roles (e.g., "$800 for four days plus bonuses"), often from non-official numbers and requesting fees. YC has publicly clarified these are scams, emphasizing that no such roles or individuals exist within their legitimate recruiting team. Always verify through official channels.

Y Combinator Criticisms and Challenges

Despite its success, YC faces:

- Extreme Selectivity: The tiny acceptance rate means "many strong companies won't get in," leading to potential burnout for persistent applicants.

- Perceived Diminishing Value: Some argue its value is more about prestige than direct program benefits, with its standard $500,000 investment (including $125,000 for 7% equity) being "not necessarily remarkable compared to alternatives." However, many alumni strongly assert the invaluable guidance and connections.

- One-Size-Fits-All Approach: With over 200 companies per batch, personalized attention can be limited, with office hours being a "few hours per week." The broad curriculum may not suit highly specialized industries.

- Founder Experience: Feedback includes instances of "harsh feedback" from partners, and the intense "heads down" focus means founders often struggle to form deep social connections within their batch. There have also been reports of negative experiences with co-founders sourced through YC's matching platform, citing issues of toxicity and manipulation. Some founders have even recounted deals falling apart at the last minute, causing significant disruption.

- Controversies: YC has been criticized for backing similar companies, a strategy defended as "sound business" to "bet broadly" when early success is unpredictable. However, this raises ethical questions, particularly when one YC company reportedly cloned an open-source codebase without proper attribution. CEO Garry Tan has strongly condemned dishonesty, emphasizing integrity and building "real products."

- Diversity Trends: While the Winter 2024 batch saw an increase in female-founded startups (approximately 22%, the highest in four batches) and a slight uptick in Black-founded startups, representation for Hispanic and Latino founders significantly declined to 6%, the lowest since Summer 2017. Remote operations during the COVID-19 pandemic led to a spike in diversity across various groups, suggesting that the return to an in-person model may inadvertently impact global inclusivity. In the Winter 2024 batch, about 75% of startups were based in North America.

YC's Enduring Impact and Future

Y Combinator "pioneered the accelerator model," transforming the startup landscape into a structured system. Its success has inspired countless accelerators worldwide, and its methodologies are now standard in the startup playbook.

YC consistently dominates its competitors in investment value, exit value, and unicorn creation rates. For instance, YC's 2012 cohort alone achieved an exit value of $93.3 billion, significantly higher than competitors. This is driven by a "flywheel effect" where success attracts top talent, and its vast data insights continuously refine its program.

Under CEO Garry Tan, YC emphasizes "honesty and integrity," building "real products," and avoiding shortcuts, directly countering past ethical lapses in Silicon Valley. This vision aims to attract ethically grounded founders.

YC's profound impact and strategic adaptability, particularly in emerging areas like AI, position it as a "continued driving force in the global innovation economy." Its influence will likely continue to shape the next wave of technological breakthroughs for decades to come.

You could be among the 1% that will be founded. Keep building.